CLICK TO VIEW MTW SUPPLEMENT PLAN (pdf)

Connect with Us!

About the MTW Program

The Moving to Work (MTW) demonstration program, established by the U.S. government in 1996, revolutionized housing assistance for low-income households nationwide. MTW empowers selected public housing authorities to devise tailored strategies to efficiently utilize federal funds, promote financial independence among residents, and enhance housing options for low-income families.

Over its more than two-decade existence, MTW agencies have consistently implemented successful initiatives that meet the needs of their communities while expanding opportunities for households. By granting flexibility in federal housing voucher and public housing programs, MTW enables agencies to develop localized solutions.

Initially, the program included 30 public housing authorities, later expanding to 39 by 2015. The Consolidated Appropriations Act of 2016 extended contracts for these agencies for 10 more years and authorized an additional 100 public housing authorities to join. Strong bipartisan support has consistently backed MTW expansions.

In 2021, the Greenville Housing Authority (TGHA) joined the program’s Landlord Incentives cohort, aiming to attract and retain landlords in the Housing Choice Voucher (HCV) Program through financial and administrative incentives. TGHA’s participation underscores the importance of MTW in tailoring programs to community needs and swiftly adapting to market changes.

MTW’s statutory goals include reducing costs, incentivizing employment among households, and increasing housing choices for low-income families. TGHA, serving over 3,291 households recognizes MTW as essential for effective and efficient public service.

For further information on MTW, including designated demonstration sites, visit HUD’s website.

Frequently Asked Questions

MTW FSS Participant Frequently Asked Questions (FAQs)

Q: What is the MTW FSS Program?

A: MTW FSS (Moving to Work Family Self-Sufficiency) is a term-limited program designed to help families achieve self-sufficiency through coaching, education, job training, resource referrals, financial literacy, and supportive services.

Q: Who can I contact if I have questions?

A: You can reach out to:

– Jenneh Jones (Director of MTW FSS): [email protected] | 864-990-0236

– LeKia Dennis (MTW FSS Specialist): [email protected] | 864-990-2136

– Meredith Villa (MTW FSS Specialist): [email protected] | 864-990-0623

– Marjory Dingwall (MTW FSS Admin Assistant): [email protected]| 864-813-5958

– Or call 864-990-1843 or email [email protected] for general inquiries.

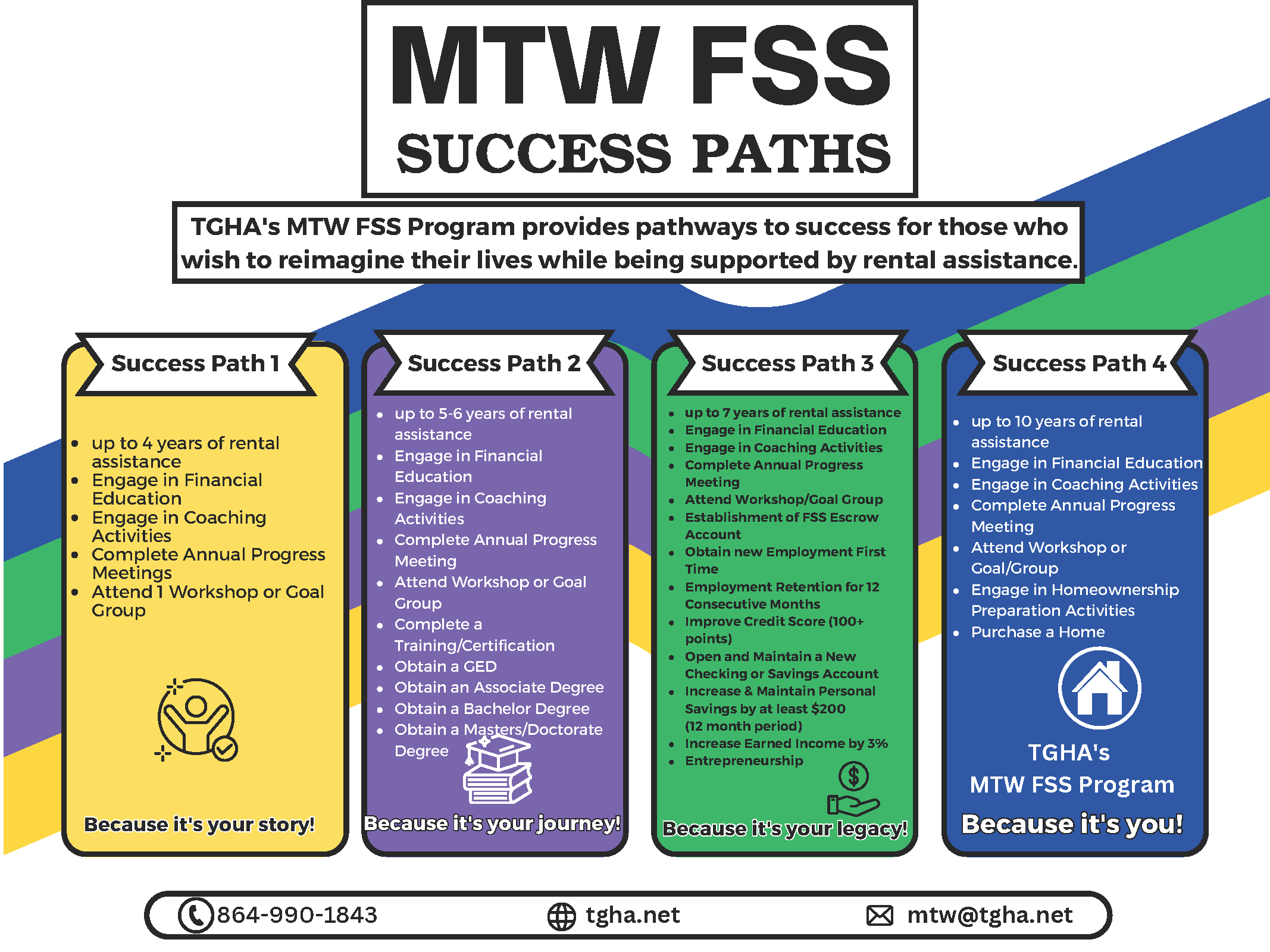

Q: What are the different Success Paths I can choose from?

A: There are four success paths:

Success Path 1- Path to Independence (up to 4 years of rental assistance)

Success Path 2-Path to Education (up to 5-6 years of rental assistance)

Success Path 3- Path to Financial Stability (up to 7 years of rental assistance)

Success Path 4-Path to Homeownership (up to 10 years of rental assistance)

Q: Can the paths be amended or extended?

A: Yes, participants may elect to change paths at any time during their participation. The program is designed to be flexible and participant-driven. You can adjust your path as your goals evolve. However, a change of path does not create a new term of participation (e.g., changing from Success Path One to Success Path Two would add a maximum of two years in one-year increments).

Q: What do I need to do to graduate from Path 1 (Independence)?

A: Complete up to 4 years of rental assistance, engage in financial education, attend annual progress meetings, participate in TGHA workshops/goal groups, and create a future housing plan. Participants who fail to select a success path will be automatically registered in Success Path One. Participation is mandatory, and failure to participate will result in the termination of assistance at any time during the four years.

Q: What incentives are available?

A: Each path has various incentives. In addition, MTW may offer numerous incentives throughout the year, including special events, invitations to different programs, backpacks, holiday gifts, fun activities, and trips. These incentives are designed to strengthen our participants’ success, support their goals, offer recreation and relaxation, and provide unique networking opportunities.

Q: What incentives are available for Path 1 (Independence)?

A: Up to $300 in cash incentives each year for attending:

– Financial Education: $50

– Coaching appointments: $50

– Progress Meeting: $100

– Workshop Attendance: $100

Q: What counts as educational progress?

A: Completion of GED, training/certification, Associate’s, Bachelor’s, Master’s, or Doctorate degrees.

Q: What incentives can I earn for Path 2 (Education)?

A: Up to $1500, depending on your academic achievement:

– GED: $300

– Certification: $250

– Associate: $500

– Bachelor: $1000

– Master/Doctorate: $1500

-Registration for the FSS escrow program

Q: What are the key milestones for Path 3 (Financial Stability)?

A: Attain employment goals, maintain employment for 12 consecutive months, obtain a competitive market credit score (600-700), open and maintain bank accounts, and increase savings. Manage chosen entrepreneurship goals.

Q: What incentives are available for Path 3 (Financial Stability)?

A: Up to $3650+ (monthly escrow), including:

– New Employment: $500

– Employment Retention: $250

– Credit Score Improvement: $100

– Bank Accounts: $200

– Savings Increase: $200

– Income Increase: $100

– Entrepreneurship: $2500

Q: What do I need to do to graduate from Path 4 (Homeownership)?

A: Complete up to 10 years of rental assistance, engage in financial education and coaching, attend workshops, provide evidence of preparation for homeownership, and purchase a home.

Q: What incentives are available for Path 4 (Homeownership)?

A: Up to $2100 in cash incentives:

– Homeownership Preparation: $100

– Home Purchase: $2000

Q: Can I earn incentives for personal goals?

A: Yes! You can earn $50 per SMART goal (up to 5 goals, totaling $250). SMART goals must be Specific, Measurable, Achievable, Relevant, and Time-bound.

Q: Is the MTW FSS program mandatory?

A: Yes. Participation is mandatory for all non-elderly, non-disabled household members between the ages of 18 and 61 who receive rental assistance through TGHA.

Q: What is expected of me as a mandatory participant?

A: As a mandatory participant, you are expected to:

– Select a Success Path aligned with your family goals

– Engage in financial education and coaching

– Attend annual progress meetings

– Participate in workshops or goal groups

– Actively work toward goals and graduation requirements for your chosen success path

Q: What happens if I don’t participate or meet the requirements?

A: Because participation is required, failure to engage may affect your eligibility for continued rental assistance. The MTW FSS team will work with you to overcome any barriers that may arise; however, you are responsible for communicating any barriers or hardships so that the MTW FSS staff can assist you in staying on track.

Q: Can I choose my own Success Path?

A: Yes! While participation is required, you have the freedom to choose the path that best fits you and your family’s needs and goals—whether it’s Path 1-independence, Path 2-education, Path 3-financial stability, or Path 4-homeownership.

Q: What if I have a disability or am over 61?

A: Individuals who are elderly (62+) or non-elderly disabled are exempt from mandatory participation but may still choose to join voluntarily if they wish to pursue personal goals with support from MTW FSS staff and community partners.

Q: How is participation determined?

A: All non-elderly, non-disabled heads of households and household members ages 18-61 are required to participate. Because there are over 1700 heads of households, a randomizer is used to determine the current eligible participants. New admissions are enrolled within 3 to 6 months of the effective date of the HAP contract.

Q: How is the Participant Family’s Path Determined?

A: An initial assessment is prepared with TGHA staff to help determine which path best suits the family’s immediate self-sufficiency goals and needs. The family plays a crucial role in deciding what is best for them.

Q: Can I graduate from the program based on my income contribution?

A: Yes. Rent is based on 32% of household income minus allowable deductions. A deduction of $500 per household member ( up to a maximum of 6 household members), a utility allowance, and eligible childcare are calculated as part of the rent formula. HCV participants may elect to pay up to 40% of their reported income toward rent if they choose a unit whose rent exceeds the budget. As income increases, the household pays more toward monthly rent. When the household income equals or exceeds the contract rent and the housing authority is no longer making a rental assistance payment, the household is ready for graduation. As a safety net, the household remains eligible for rental assistance for six months beyond the last rental assistance payment in the event of an unanticipated change in income.

Additional FAQs

Q: What is the Total Tenant Payment (TTP) under MTW?

A: For all non-elderly, non-disabled families, the TTP is set at 32% of the gross income of all household members minus allowable deductions.

Q: Do MTW participants receive utility reimbursement checks?

A: No, MTW participants do not receive utility reimbursement checks; however, they do receive a utility allowance in the calculation of rent. Elderly, disabled, and participants in special programs continue to receive utility reimbursement payments.

Q: Are there other deductions under MTW?

A: Yes, MTW participants receive $500 per person up to 6 people, with a maximum deduction of $3000. Childcare expenses that permit employment or education are allowable deductions.

Q: What are the work or education requirements for MTW participants?

A: All adult household members must work or attend school for a combined total of 30 hours per week or be enrolled in full-time education.

Q: What happens if a participant does not meet the work requirement?

A: Non-compliance results in coaching and referral to appropriate partners to seek remedies. Participants’ cooperation will support continued rental assistance. Participants who fail to cooperate may be subject to termination.

Q: When is an interim recertification required?

A: Interim recertifications are triggered if income decreases by $200 or more, increases by $500 or more per month, or changes in family composition.

Q: What is the process for porting into TGHA under MTW?

A: Participants porting into TGHA receive a handout explaining mandatory MTW participation. Portability clients are required to participate in MTW.

Q: Can participants request hardship exemptions?

A: Yes, participants may submit written hardship requests for MTW-related activities. These requests are reviewed individually.

Q: What is an FSS Escrow Account?

A: As the participant’s earned income increases and rent increases, escrow is earned. These interest-bearing savings can be used for any self-sufficiency activities, such as vehicle repairs, childcare, school fees, medical expenses, uniforms, books, supplies, work-related costs, and homeownership costs.

Q: Can my HCV voucher be used for Homeownership?

A: Yes! Your HCV voucher can be transitioned to an HCV Homeownership voucher through this program once you have proven financial stability with:

- 3 years of stable employment history

- $2000 of savings

- 640 credit score

- HUD-certified homebuyers’ education

Q: What if someone would like to participate before they are randomly selected?

A: Participation in the MTW Family Self-Sufficiency (FSS) program is mandatory for all non-elderly, non-disabled adults receiving housing assistance through the Greenville Housing Authority. To ensure accurate tracking and support, MTW FSS staff kindly request that participants respond once they receive an invitation to attend an orientation session.

Success Paths

Testimonials

Gloria Gomez

I’ve already benefited from the traditional FSS program by furthering my education and getting a better job. I’m excited to use this new version of FSS to create a brighter future.

Toni Palmer

My name is Toni Palmer, and I chose success path 1. I thought that path best fit what I want my journey to be. I am taking steps to start my own business, so I figured that with financial education and coaching that will help me to succeed.

Catetra Byrd

I joined the 4-year plan (PATH 1). The only reason I did the 4 year is because of my age. To me, this is a great program. I’m excited to become a homeowner. The FSS staff are so easy to work with. They are kind, compassionate, understanding, and really helpful. They have a lot of patience. I wish this program was around when I was younger. Thanks TGHA FOR THIS OPPORTUNITY.

Marshell Roper

In my years of being a client with TGHA, I had never thought about opportunities of not having assistance given to me. I had become complacent and did not know how to come out of complacency, but with FSS now I have a chance of independence and having opportunities to enhance my life in areas I never thought I could receive help. Thank you, TGHA and FSS, for the chance to grow and live independently.

Moving To Work

The Moving to Work (MTW) demonstration program, established by the U.S. government in 1996, revolutionized housing assistance for low-income households nationwide. MTW empowers selected public housing authorities to devise tailored strategies to efficiently utilize federal funds, promote financial independence among residents, and enhance housing options for low-income families.

Over its more than two-decade existence, MTW agencies have consistently implemented successful initiatives that meet the needs of their communities while expanding opportunities for households. By granting flexibility in federal housing voucher and public housing programs, MTW enables agencies to develop localized solutions.

Initially, the program included 30 public housing authorities, later expanding to 39 by 2015. The Consolidated Appropriations Act of 2016 extended contracts for these agencies for 10 more years and authorized an additional 100 public housing authorities to join. Strong bipartisan support has consistently backed MTW expansions.

In 2021, the Greenville Housing Authority (TGHA) joined the program’s Landlord Incentives cohort, aiming to attract and retain landlords in the Housing Choice Voucher (HCV) Program through financial and administrative incentives. TGHA’s participation underscores the importance of MTW in tailoring programs to community needs and swiftly adapting to market changes.

MTW’s statutory goals include reducing costs, incentivizing employment among households, and increasing housing choices for low-income families. TGHA, serving over 3,291 households recognizes MTW as essential for effective and efficient public service.

For further information on MTW, including designated demonstration sites, visit HUD’s website.

MTW FSS Participant Frequently Asked Questions (FAQs)

Q: What is the MTW FSS Program?

A: MTW FSS (Moving to Work Family Self-Sufficiency) is a term-limited program designed to help families achieve self-sufficiency through coaching, education, job training, resource referrals, financial literacy, and supportive services.

Q: Who can I contact if I have questions?

A: You can reach out to:

– Jenneh Jones (Director of MTW FSS): [email protected] | 864-990-0236

– LeKia Dennis (MTW FSS Specialist): [email protected] | 864-990-2136

– Meredith Villa (MTW FSS Specialist): [email protected] | 864-990-0623

– Marjory Dingwall (MTW FSS Admin Assistant): [email protected]| 864-813-5958

– Or call 864-990-1843 or email [email protected] for general inquiries.

Q: What are the different Success Paths I can choose from?

A: There are four success paths:

Success Path 1- Path to Independence (up to 4 years of rental assistance)

Success Path 2-Path to Education (up to 5-6 years of rental assistance)

Success Path 3- Path to Financial Stability (up to 7 years of rental assistance)

Success Path 4-Path to Homeownership (up to 10 years of rental assistance)

Q: Can the paths be amended or extended?

A: Yes, participants may elect to change paths at any time during their participation. The program is designed to be flexible and participant-driven. You can adjust your path as your goals evolve. However, a change of path does not create a new term of participation (e.g., changing from Success Path One to Success Path Two would add a maximum of two years in one-year increments).

Q: What do I need to do to graduate from Path 1 (Independence)?

A: Complete up to 4 years of rental assistance, engage in financial education, attend annual progress meetings, participate in TGHA workshops/goal groups, and create a future housing plan. Participants who fail to select a success path will be automatically registered in Success Path One. Participation is mandatory, and failure to participate will result in the termination of assistance at any time during the four years.

Q: What incentives are available?

A: Each path has various incentives. In addition, MTW may offer numerous incentives throughout the year, including special events, invitations to different programs, backpacks, holiday gifts, fun activities, and trips. These incentives are designed to strengthen our participants’ success, support their goals, offer recreation and relaxation, and provide unique networking opportunities.

Q: What incentives are available for Path 1 (Independence)?

A: Up to $300 in cash incentives each year for attending:

– Financial Education: $50

– Coaching appointments: $50

– Progress Meeting: $100

– Workshop Attendance: $100

Q: What counts as educational progress?

A: Completion of GED, training/certification, Associate’s, Bachelor’s, Master’s, or Doctorate degrees.

Q: What incentives can I earn for Path 2 (Education)?

A: Up to $1500, depending on your academic achievement:

– GED: $300

– Certification: $250

– Associate: $500

– Bachelor: $1000

– Master/Doctorate: $1500

-Registration for the FSS escrow program

Q: What are the key milestones for Path 3 (Financial Stability)?

A: Attain employment goals, maintain employment for 12 consecutive months, obtain a competitive market credit score (600-700), open and maintain bank accounts, and increase savings. Manage chosen entrepreneurship goals.

Q: What incentives are available for Path 3 (Financial Stability)?

A: Up to $3650+ (monthly escrow), including:

– New Employment: $500

– Employment Retention: $250

– Credit Score Improvement: $100

– Bank Accounts: $200

– Savings Increase: $200

– Income Increase: $100

– Entrepreneurship: $2500

Q: What do I need to do to graduate from Path 4 (Homeownership)?

A: Complete up to 10 years of rental assistance, engage in financial education and coaching, attend workshops, provide evidence of preparation for homeownership, and purchase a home.

Q: What incentives are available for Path 4 (Homeownership)?

A: Up to $2100 in cash incentives:

– Homeownership Preparation: $100

– Home Purchase: $2000

Q: Can I earn incentives for personal goals?

A: Yes! You can earn $50 per SMART goal (up to 5 goals, totaling $250). SMART goals must be Specific, Measurable, Achievable, Relevant, and Time-bound.

Q: Is the MTW FSS program mandatory?

A: Yes. Participation is mandatory for all non-elderly, non-disabled household members between the ages of 18 and 61 who receive rental assistance through TGHA.

Q: What is expected of me as a mandatory participant?

A: As a mandatory participant, you are expected to:

– Select a Success Path aligned with your family goals

– Engage in financial education and coaching

– Attend annual progress meetings

– Participate in workshops or goal groups

– Actively work toward goals and graduation requirements for your chosen success path

Q: What happens if I don’t participate or meet the requirements?

A: Because participation is required, failure to engage may affect your eligibility for continued rental assistance. The MTW FSS team will work with you to overcome any barriers that may arise; however, you are responsible for communicating any barriers or hardships so that the MTW FSS staff can assist you in staying on track.

Q: Can I choose my own Success Path?

A: Yes! While participation is required, you have the freedom to choose the path that best fits you and your family’s needs and goals—whether it’s Path 1-independence, Path 2-education, Path 3-financial stability, or Path 4-homeownership.

Q: What if I have a disability or am over 61?

A: Individuals who are elderly (62+) or non-elderly disabled are exempt from mandatory participation but may still choose to join voluntarily if they wish to pursue personal goals with support from MTW FSS staff and community partners.

Q: How is participation determined?

A: All non-elderly, non-disabled heads of households and household members ages 18-61 are required to participate. Because there are over 1700 heads of households, a randomizer is used to determine the current eligible participants. New admissions are enrolled within 3 to 6 months of the effective date of the HAP contract.

Q: How is the Participant Family’s Path Determined?

A: An initial assessment is prepared with TGHA staff to help determine which path best suits the family’s immediate self-sufficiency goals and needs. The family plays a crucial role in deciding what is best for them.

Q: Can I graduate from the program based on my income contribution?

A: Yes. Rent is based on 32% of household income minus allowable deductions. A deduction of $500 per household member ( up to a maximum of 6 household members), a utility allowance, and eligible childcare are calculated as part of the rent formula. HCV participants may elect to pay up to 40% of their reported income toward rent if they choose a unit whose rent exceeds the budget. As income increases, the household pays more toward monthly rent. When the household income equals or exceeds the contract rent and the housing authority is no longer making a rental assistance payment, the household is ready for graduation. As a safety net, the household remains eligible for rental assistance for six months beyond the last rental assistance payment in the event of an unanticipated change in income.

Additional FAQs

Q: What is the Total Tenant Payment (TTP) under MTW?

A: For all non-elderly, non-disabled families, the TTP is set at 32% of the gross income of all household members minus allowable deductions.

Q: Do MTW participants receive utility reimbursement checks?

A: No, MTW participants do not receive utility reimbursement checks; however, they do receive a utility allowance in the calculation of rent. Elderly, disabled, and participants in special programs continue to receive utility reimbursement payments.

Q: Are there other deductions under MTW?

A: Yes, MTW participants receive $500 per person up to 6 people, with a maximum deduction of $3000. Childcare expenses that permit employment or education are allowable deductions.

Q: What are the work or education requirements for MTW participants?

A: All adult household members must work or attend school for a combined total of 30 hours per week or be enrolled in full-time education.

Q: What happens if a participant does not meet the work requirement?

A: Non-compliance results in coaching and referral to appropriate partners to seek remedies. Participants’ cooperation will support continued rental assistance. Participants who fail to cooperate may be subject to termination.

Q: When is an interim recertification required?

A: Interim recertifications are triggered if income decreases by $200 or more, increases by $500 or more per month, or changes in family composition.

Q: What is the process for porting into TGHA under MTW?

A: Participants porting into TGHA receive a handout explaining mandatory MTW participation. Portability clients are required to participate in MTW.

Q: Can participants request hardship exemptions?

A: Yes, participants may submit written hardship requests for MTW-related activities. These requests are reviewed individually.

Q: What is an FSS Escrow Account?

A: As the participant’s earned income increases and rent increases, escrow is earned. These interest-bearing savings can be used for any self-sufficiency activities, such as vehicle repairs, childcare, school fees, medical expenses, uniforms, books, supplies, work-related costs, and homeownership costs.

Q: Can my HCV voucher be used for Homeownership?

A: Yes! Your HCV voucher can be transitioned to an HCV Homeownership voucher through this program once you have proven financial stability with:

- 3 years of stable employment history

- $2000 of savings

- 640 credit score

- HUD-certified homebuyers’ education

Q: What if someone would like to participate before they are randomly selected?

A: Participation in the MTW Family Self-Sufficiency (FSS) program is mandatory for all non-elderly, non-disabled adults receiving housing assistance through the Greenville Housing Authority. To ensure accurate tracking and support, MTW FSS staff kindly request that participants respond once they receive an invitation to attend an orientation session.

Gloria Gomez

I’ve already benefited from the traditional FSS program by furthering my education and getting a better job. I’m excited to use this new version of FSS to create a brighter future.

Toni Palmer

My name is Toni Palmer, and I chose success path 1. I thought that path best fit what I want my journey to be. I am taking steps to start my own business, so I figured that with financial education and coaching that will help me to succeed.

Catetra Byrd

I joined the 4-year plan (PATH 1). The only reason I did the 4 year is because of my age. To me, this is a great program. I’m excited to become a homeowner. The FSS staff are so easy to work with. They are kind, compassionate, understanding, and really helpful. They have a lot of patience. I wish this program was around when I was younger. Thanks TGHA FOR THIS OPPORTUNITY.

Marshell Roper

In my years of being a client with TGHA, I had never thought about opportunities of not having assistance given to me. I had become complacent and did not know how to come out of complacency, but with FSS now I have a chance of independence and having opportunities to enhance my life in areas I never thought I could receive help. Thank you, TGHA and FSS, for the chance to grow and live independently.